CAGR Calculator

Disclaimer: Whilst every effort has been made in building our calculator tools, we are not to be held liable for any damages or monetary losses arising out of or in connection with their use. Full disclaimer.

Unveiling the Power of the CAGR Calculator: A Comprehensive Guide

In the ever-changing world of finance and investments, understanding the growth trajectory of your portfolio is vital. One of the most reliable tools for evaluating investment performance is the Compound Annual Growth Rate (CAGR) calculator. This tool not only simplifies the complexities of growth calculations but also provides valuable insights that empower investors to make data-driven decisions.

In this guide, we’ll break down the essence of CAGR, how a CAGR calculator works, and the many ways it can enhance your investment strategies and decision-making.

What is CAGR?

Before diving into the functionality of the CAGR calculator, it’s essential to understand Compound Annual Growth Rate (CAGR). CAGR is a metric that provides a smoothed annual growth rate of an investment over a specific period, assuming the investment grows at a constant rate. Unlike simple growth rates, CAGR accounts for compounding, offering a realistic picture of how your investment has grown over time.

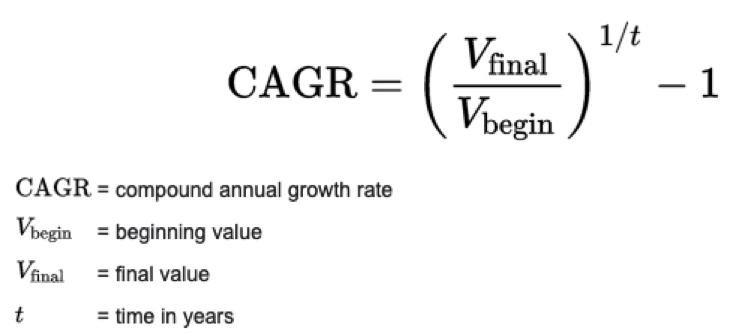

The Formula for CAGR:

CAGR smooths out fluctuations in annual returns to provide a single, consistent growth rate that reflects the overall performance of an investment.

What is a CAGR Calculator?

A CAGR calculator is a digital tool that automates the process of calculating CAGR. Instead of manually working through the formula, you can simply input key data such as the initial investment value, final value, and the investment duration. Within seconds, the calculator provides you with the compound annual growth rate, eliminating the risk of errors and saving time.

Key Features of a CAGR Calculator:

- Ease of Use: A user-friendly interface that requires minimal effort to input data.

- Accuracy: Automates the complex CAGR calculation to ensure precise results.

- Time Efficiency: Quickly delivers results, freeing you to focus on strategic decision-making.

- Versatility: Works for various asset classes—stocks, mutual funds, real estate, or even business growth metrics.

Why Is the CAGR Calculator Important?

CAGR calculators provide unparalleled clarity when assessing investment performance. Here’s why they are essential:

1. Performance Comparison Across Investments

CAGR standardizes growth rates, allowing you to compare the performance of multiple investments. Whether it’s stocks, mutual funds, or fixed deposits, CAGR provides a common framework to identify the best-performing asset.

2. Evaluating Long-Term Growth

Because CAGR accounts for compounding, it offers a more accurate view of how an investment has grown over time, making it invaluable for long-term financial planning.

3. Data-Driven Decision-Making

The CAGR calculator eliminates guesswork by providing tangible metrics. This empowers investors to make informed decisions based on historical performance, ensuring better resource allocation.

4. Strategic Financial Planning

CAGR plays a pivotal role in projecting future growth. By evaluating past growth rates, you can set realistic financial goals and tailor your investment strategies accordingly.

How to Use a CAGR Calculator

Using a CAGR calculator is straightforward. Follow these steps to unlock its potential:

- Identify the Time Period: Determine the number of years (or months) over which the growth will be calculated.

- Collect Investment Data: Gather the initial value (beginning value) and the final value (ending value) of the investment.

- Input the Data: Enter the beginning value, ending value, and time period into the calculator.

- Calculate: Click the “Calculate” button. The calculator will instantly compute the CAGR and display the annualized growth rate.

- Analyze the Results: Use the CAGR result to assess your investment's performance and guide your financial decisions. A higher CAGR signifies stronger growth, while a lower CAGR may indicate the need for adjustments to your strategy.

Applications of the CAGR Calculator

Beyond basic calculations, the CAGR calculator can be leveraged for advanced investment strategies. Here’s how:

1. Comparative Investment Analysis

Use the calculator to compare the performance of different investment options, such as:

- Stocks vs. mutual funds.

- Real estate vs. fixed-income instruments.

This allows you to make informed decisions about where to allocate resources for maximum returns.

2. Portfolio Optimization

Evaluate the CAGR of individual assets in your portfolio to identify top performers. This insight helps you rebalance your portfolio by allocating more capital to high-growth investments.

3. Long-Term Planning

CAGR calculators are invaluable for projecting future growth. For example, if a mutual fund has grown at 8% CAGR historically, you can use this rate to estimate its future performance and align it with your financial goals.

4. Scenario Testing

Experiment with different growth rates and time frames to visualize how changes in market conditions or investment strategies might impact returns.

Benefits of Using a CAGR Calculator

1. Simplified Analysis

CAGR takes the complexity out of analyzing investment growth by presenting a single, consolidated annualized rate.

2. Precision and Accuracy

By automating calculations, the CAGR calculator eliminates human error, ensuring you get reliable data every time.

3. Saves Time

In just seconds, the calculator delivers results that would take much longer to compute manually.

4. Encourages Financial Literacy

By using the calculator, you develop a deeper understanding of how compounding and growth rates affect investments, empowering you with financial knowledge.

Common Misconceptions About CAGR

While CAGR is a powerful tool, it’s important to understand its limitations:

1. CAGR Doesn’t Reflect Volatility

CAGR provides a smoothed growth rate and does not account for yearly fluctuations or volatility in returns. Consider using additional metrics like standard deviation or Sharpe ratio for a comprehensive analysis.

2. CAGR Is Not a Future Predictor

CAGR reflects historical performance and cannot guarantee future returns. Investors should consider market trends and other factors when projecting future growth.

Choosing the Right CAGR Calculator

Not all CAGR calculators are created equal. Here’s what to look for:

- Accuracy: Choose a calculator that delivers precise and reliable results.

- Ease of Use: Opt for a user-friendly interface that simplifies input.

- Additional Features: Advanced calculators may offer features like graphing capabilities or historical data comparisons.

- Accessibility: Ensure the tool works seamlessly on multiple devices for on-the-go usage.

The Future of CAGR Calculations

As technology evolves, CAGR calculators are expected to integrate advanced features like real-time data analysis, AI-driven insights, and predictive analytics. These innovations will make investment analysis even more accurate, efficient, and accessible to both novice and seasoned investors.

Additionally, as sustainable investing gains traction, CAGR calculators may incorporate ESG (Environmental, Social, and Governance) metrics, helping investors evaluate not just financial returns but also the ethical impact of their portfolios.

Conclusion: Leverage the Power of the CAGR Calculator

In the complex world of investments, the CAGR calculator serves as a beacon of clarity. By simplifying the analysis of compound growth and offering actionable insights, it empowers investors to make smarter, more informed decisions.

Whether you’re optimizing your portfolio, comparing investment options, or planning for long-term goals, the CAGR calculator is an indispensable tool in your financial toolkit.

As you embrace this powerful resource, you’re not just crunching numbers—you’re unlocking a deeper understanding of your financial landscape and setting the stage for sustained growth and success. Let the CAGR calculator guide you on your investment journey, ensuring that every step is aligned with your goals and aspirations.